QuickBooks Features: Invoicing, Expenses & Cloud Accounting

Also consider whether you’ll work with an accountant or bookkeeper, now or in the future. Here’s a look at all of QuickBooks’ small-business products, including accounting, point-of-sale and payroll software. Plus, you’ll find details on how QuickBooks stacks up against its competitors, as well as alternatives to consider. QuickBooks Online syncs with more than 750 different third-party business apps, ranging from point-of-sale apps to payment acceptance tools and beyond.

How to Choose the Right QuickBooks for Your Business

Expense tracking – Categorize business expenses for tax prep and reporting. Multi-user access – Add employees or accountants to simplify collaboration. Service businesses, retailers, and other SMBs that value offline accessibility and don’t need heavy inventory features. This covers the key ways QuickBooks aims to help small businesses manage their finances all in one place while eliminating tedious workflows.

QuickBooks pricing

In that role, Ryan co-authored the Student Loan Ranger blog in partnership with U.S. News & World Report, as well as wrote and edited content about education financing and financial literacy for multiple online properties, e-courses and more. Ryan also previously oversaw the production of life science journals as a managing editor for publisher Cell Press. Get in-depth insights on its usability, features, customer service, and pricing. What’s more, you can sync your Wise account with Quickbooks Online to track your bills in real-time. This way, the customer or supplier can pay your invoice in their local currency.

Inventory Management

QuickBooks Online Simple Start costs $30 per month, includes only one account user (plus access for two accountants) and does not offer billable hours tracking, bill pay or inventory management. For multiple users, how to calculate overtime pay bill pay and the ability to add billable hours to invoices, you’ll need to upgrade to the Essentials plan, which costs $60 per month. For inventory management, you’ll need to opt for the Plus plan at $90 per month.

Accounting Guidelines for Accounts Payable & Disbursements

Our research team has crunched the numbers, testing eight software brands across eight research subcategories to confirm that QuickBooks offers the best service with a top overall score of 4.7/5 points. QuickBooks has the best payroll software as well, although we offer a quick quiz that can pair you https://www.simple-accounting.org/ with all the top payroll options for your industry. If you’d like to try other great accounting software, we have you covered as well, with deals on FreshBooks, Xero, and others. We’d also highly recommend FreshBooks, a solution that has almost as many features and comes at a slightly lower price.

The QuickBooks product line includes several solutions to support different business needs, including QuickBooks Online, QuickBooks Desktop, QuickBooks Payroll, QuickBooks Time, and QuickBooks Checking. QuickBooks also offers both a desktop version for a fixed fee and an online version accessible through your web browser, tablet, or smartphone for a monthly or yearly subscription. Some features, such as payroll management and payment processing, incur an additional fee regardless of which version you choose. QuickBooks offers a separate payments solution for Desktop clients with slightly different processing rates.

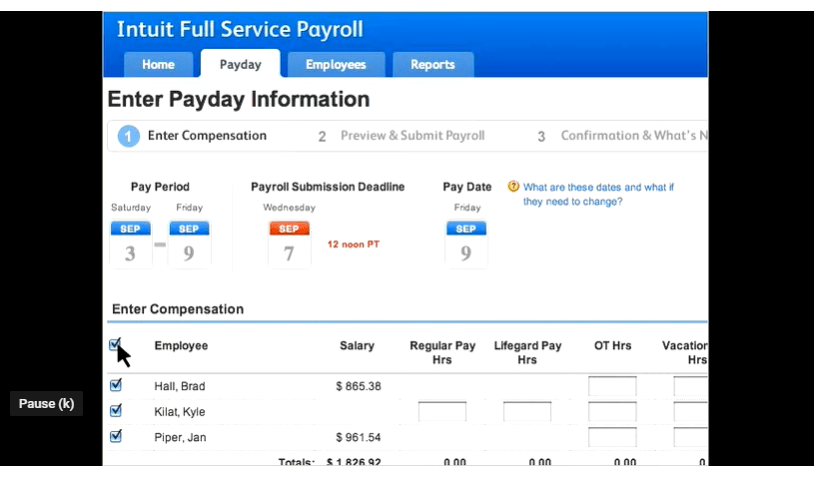

QuickBooks Online also syncs with a variety of payroll tools, including the accountant-friendly QuickBooks Online Payroll. While QuickBooks Online users don’t get a discount when signing up for QuickBooks Payroll, the two software products integrate seamlessly with one another and are equally easy to use. QuickBooks has an accounting tool specifically for freelancers called QuickBooks Online Self-Employed, which starts at $15 a month. QuickBooks Self-Employed tackles basic freelance bookkeeping features like expense tracking, receipt uploading, tax categorizing, quarterly tax estimating and mileage tracking. You can get a 30-day free trial to use the software (if you do so, you won’t receive any time-limited promotional pricing for new users).

This comprehensive guide will explore what QuickBooks offers, highlights of the various editions, how it works, top features, pricing, and ideal user profiles. With a strong understanding of what QuickBooks is, who it’s best suited for, and how to leverage it, you can determine if https://www.accountingcoaching.online/documents-requested-in-a-letter-of-credit/ it’s the right solutions for your business needs. While we don’t recommend using Excel as your base bookkeeping program, Excel has many great accounting uses. Our comparison of QuickBooks Online vs Excel will help you better understand the differences between the two programs.

These include TurboTax (for preparation of personal income tax returns) and ProConnect (tax software for accounting professionals). Get to know «What is QuickBooks» and gain insights into its various types and powerful features. Learn about the advantages of using QuickBooks and find valuable tips for optimising its usage. Whether you’re a business owner or an aspiring accountant, this blog will help you understand QuickBooks and its essential role in managing finances. Another notable difference is QuickBooks Online offers a Self-Employed version for $15 per month, which is not available with QuickBooks Desktop.

- Here’s a look at all of QuickBooks’ small-business products, including accounting, point-of-sale and payroll software.

- In the other states, the program is sponsored by Community Federal Savings Bank, to which we’re a service provider.

- Quicken tracks your account balances, transactions, investments, personal budgeting, loans, and any other part of your personal financial life.

- We rate QuickBooks Payroll highly and it will appear as the “Payroll” tab on your dashboard if you use it.

And because you can make sure your vendor gets paid right on time, and not a day sooner, it means you keep your cash longer and improve your cash flow. If you want to use your software anywhere you have an internet connection, you’ll likely want to focus on QuickBooks Online or pay more to add remote access through hosting to QuickBooks Enterprise. QuickBooks Payroll starts at $45 a month plus $6 per employee paid per month, and new users can choose between a 30-day free trial or 50% off discount just as they can with QuickBooks Online. While QuickBooks Self-Employed is a passable income-tracking and invoicing app for the self-employed, it’s pricier than other freelance-friendly accounting tools like Wave Accounting and Xero.

Via QuickBooks Payments, which is included free (apart from industry-standard transaction fees) with each plan, users can also configure invoices to accept online bank transfers and credit card payments. QuickBooks Desktop is more traditional accounting software that you download and install on your computer, while QuickBooks Online is cloud-based accounting software you access through the internet. For the Desktop version, you pay an annual fee starting at $1,922 per year, and the cloud-based option starts at $15 per month. Both versions have mobile apps, but the app for the Desktop version primarily functions as a way to upload receipts, and the Online mobile app is robust in comparison.